Graphite becomes Critical

Graphite has been most known to the consumer as a key test-taking tool and writing instrument – see your #2 pencil! In recent years, its unique qualities have steered the carbon mineral to the forefront of raw material demand in the Cleantech and semiconductor industries.

Graphite’s high heat resistance (2500º C), which has allowed for its historical role in steel manufacturing (electric arc furnaces), is the same quality currently driving demand in the new sectors. Applications in manufacturing processes and as product components in the electric vehicle, semiconductor, and power storage sectors have cemented graphite’s status as an essential raw material for the foreseeable future.

Current estimates from the International Energy Agency forecast 25 times more graphite demand in 2040 when compared to 2020, to meet measures put forward in the 2015 Paris Agreements.

Source: World Bank

Synthetic vs Natural

Synthetic graphite is produced and refined in laboratories through a process called hot isostatic processing (hip). Mining [and refining] natural graphite is cheaper per ton but the end product is not comparable to the conductivity of isostatic graphite. It should be noted that synthetic graphite production releases around twice as many greenhouse gasses as the process of naturally mined graphite deposits.

DH Mining Open Pit Graphite Mine (Mozambique)

Syrah Resources Battery Anode Material Processing Plant (Louisiana):

Government of Canada:

The majority of end market uses focus on steel and iron production. Synthetic and natural graphite-based electrodes are used in manufacturing furnaces, recarbursing applications in specialized cast iron production, and further uses in the lining of steel refectory walls. Each of these indicate the historic importance of graphite to industrial heat intensive processes.

Catalysts

Electric Vehicles

In electric vehicle batteries, high purity natural graphite has recently been used in equal parts with synthetic graphite as battery anode material. Market standard lithium ion (Li-Ion) batteries are comprised of 25% graphite, weighing 50kg, overshadowing the 8kg of lithium found in the same batteries. Goldman Sachs forecasts EV sales as half of the total automobile market in 2035, in hand with an expected automobile industry valuation of $8.3 trillion that year. (BCG)

Semiconductors

In the semiconductor industry, certain processes demand isostatic graphite, and natural graphite is not an option. Silicon Carbide (SiC) semiconductors are major components in EV power management, EV charging stations, and solar energy systems. Most importantly, the process of growing Silicone Carbide crystals demands large quantities of isostatic graphite, due to high temperatures of 1500º C. Bloomberg reports indicate an expected CAGR of 26% through 2031, an increase in market size to $7 billion for SiC semiconductors.

Policy

Recent passage of the Inflation Reduction Act cited 50 critical minerals, including graphite, that allow battery cell producing companies to claim US tax credits based on cell capacity and output. The Green New Deal in Europe does not cite specific minerals as priorities, but EU government Electric Vehicle initiatives support graphite market expansion[1].

Supply Chain

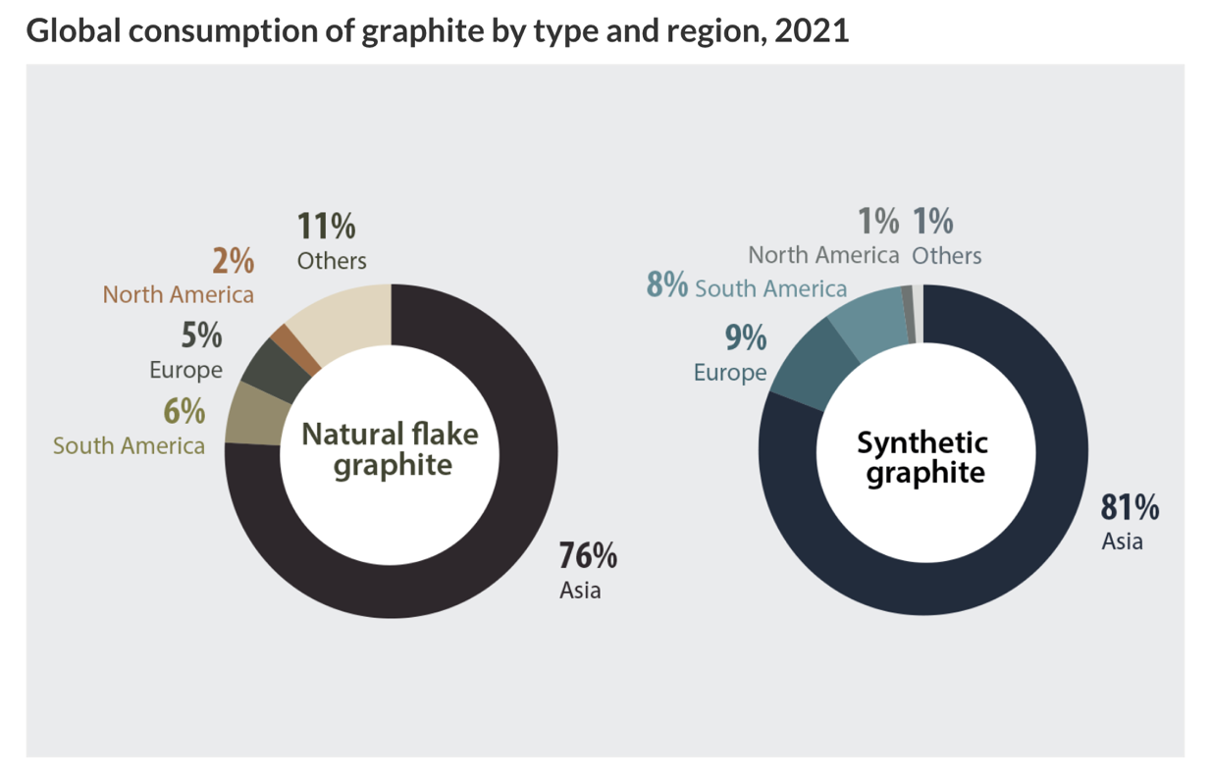

Where has the world been getting its graphite? China. Dominating 80% of synthetic and natural graphite production and refinement, China has served as the world graphite supplier for over 20 years. Counties have been scrambling to find alternative suppliers in a transformation away from eastern reliance.

Africa is a potential emerging alternative source, with mining projects under operation and construction in four sub-Saharan countries, projecting substantial output by 2025. NextSource Materials (NSRCF) and Syrah Resources (SYAAF) are two companies with large operations and strategic partnerships capable of sustained growth.

Ukraine and Russia have both been historical suppliers and processors of graphite. Operations have largely ceased since the start of conflict in February 2022 .

Government of Canada:

The majority of companies are vertically structured from production to purification and hold contractual selling agreements with major battery manufacturers.

Major sellers

China Minmetals Corp

AMG Graphite (AMG.AS)

Cocan Hubei Graphite Mill Inc

Qindao Black Dragon Graphite Co

Nacional de Grafite - Brazil

SGL Carbon (SGLFF)

Showa Denko (SHWDF:OTC)

GrafTech International Ltd (EAF)

Major Buyers

BYD (BYDDY:OTC)

Panasonic (PCRFY:OTC)

Foxconn (FXCOF:OTC)

LG Chem (LGCLF:OTC)

SK (SKCOF:OTC)

The battery manufacturing market is a ‘key account’ business for graphite demand, with concentrated buyers demanding the majority of graphite’s end market use. In other applications such as recarbursing and foundry uses, buyers are widely distributed.

Substitution Risk

Silicone is the most rumored substitute to graphite. Currently, few silicone based electric vehicle batteries are in production, but battery manufacturers will be quick to jump to a superior anode material that allows for increased performance. Silicones cost, and tendency to contract and expand currently leave graphite with a leading edge in battery anode material .

Review

To summarize, graphite is a critical mineral for multiple cleantech and semiconductor products, the most prominent being lithium-ion batteries used in electric vehicles. Natural graphite offers reduced energy usage when compared to synthetic graphite, and western countries looking to lessen reliance on China, who historically dominates the market, currently have few alternatives for supply. Many companies are moving to develop mines and subsequent supply chains to meet western manufacturing demand. Nouveau Monde Graphite (NMG), GrafTech International (EAF), and Syrah Resources (SYAAF) are a few publicly traded companies with this goal. Graphite demand is expected to triple by 2025, and again by 2030, only as a precursor for the necessary levels to meet global clean energy initiatives. Supplier competition could factor into market investment, but there is a foreseeable short-term future where demand is underfilled, and companies able to operate will generate profit parallel to maximum graphite output.

[1] https://www.npr.org/2023/03/30/1166921698/eu-zero-emission-cars#:~:text=on%20March%2023.-,Starting%20in%202035%2C%20all%20cars%20sold%20in%20the%20European,will%20be%20zero%2Demission%20vehicles.&text=European%20Union%20member%20states%20gave,starting%20in%20the%20year%202035.

Sources

Goldman Sachs

Government of Canada

Bloomberg

Mozambique 360 Mining Image

https://360mozambique.com/business/mining/exploration-of-graphite-in-nipepe-niassa-starts-next-year/

Graphite Processing Plant Image

https://www.mining.com/web/syrah-resources-to-expand-louisiana-graphite-processing-facility/

Cover Image

https://www.marketindex.com.au/news/investing-in-graphite-a-comprehensive-guide-for-asx-investors